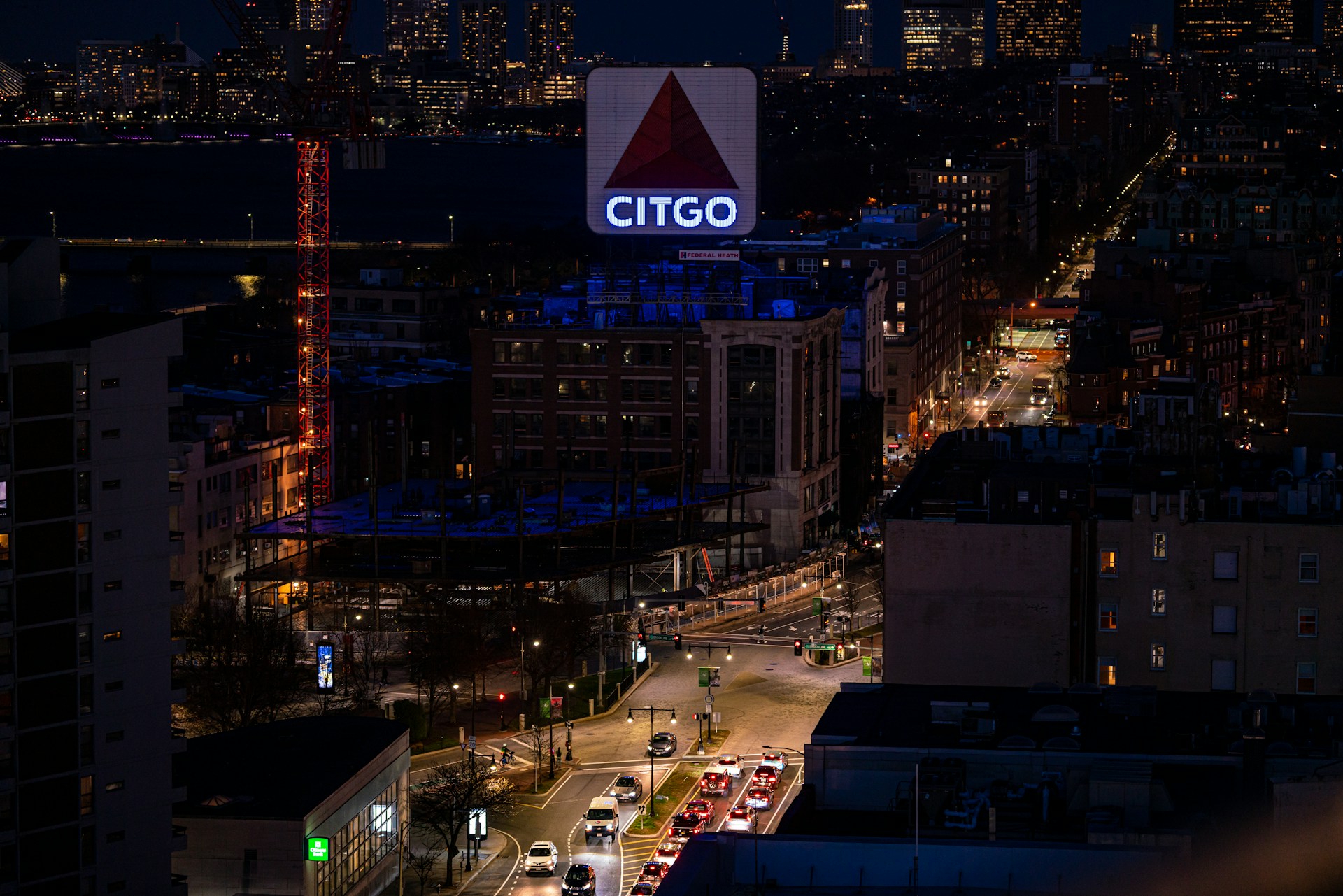

The long-running battle over Citgo Petroleum’s ownership has reached its decisive stage, as a Delaware court begins hearings to determine the outcome of an auction for shares in its parent, PDV Holding. Creditors holding nearly nineteen billion dollars in claims are pressing their cases, while bidders present competing visions for how the prized U.S. refiner should be managed. The proceedings will not only resolve control of Citgo but will also test how courts balance complex creditor interests in cross-border disputes.

Amber Energy, affiliated with Elliott Investment Management, has emerged as the leading bidder with a late offer of nearly six billion dollars. Its proposal includes paying off bondholders tied to PDVSA’s contested 2020 debt, an element that adds both weight and controversy to the bid. Earlier, a subsidiary of Gold Reserve had been recommended as frontrunner, but the dynamics shifted sharply with Amber’s revised terms, intensifying tensions among stakeholders.

Creditors opposing Amber’s approach argue that prioritising payments to bondholders risks diminishing the pool available to others, setting off legal arguments that cut to the heart of fairness in the distribution process. The parallel case in New York, which questions the validity of the 2020 bonds themselves, further complicates the matter. If those bonds are deemed unenforceable, the foundations of Amber’s bid could be weakened, altering both the auction’s outcome and the precedent for handling disputed sovereign debt.

For Citgo, the stakes extend beyond balance sheets. Control of the company carries strategic importance given its role as one of the largest refiners in the United States, raising questions of operational stability, foreign influence and investor confidence. The auction has thus become more than a commercial transaction; it is a convergence of legal, financial and geopolitical pressures.

What unfolds in Delaware will resonate far beyond the courtroom. The ruling will determine not only how creditors are paid but also how international asset disputes involving state-owned enterprises are adjudicated. As such, the Citgo case stands as a landmark in the evolving relationship between sovereign debt, corporate governance and the rule of law in global markets.