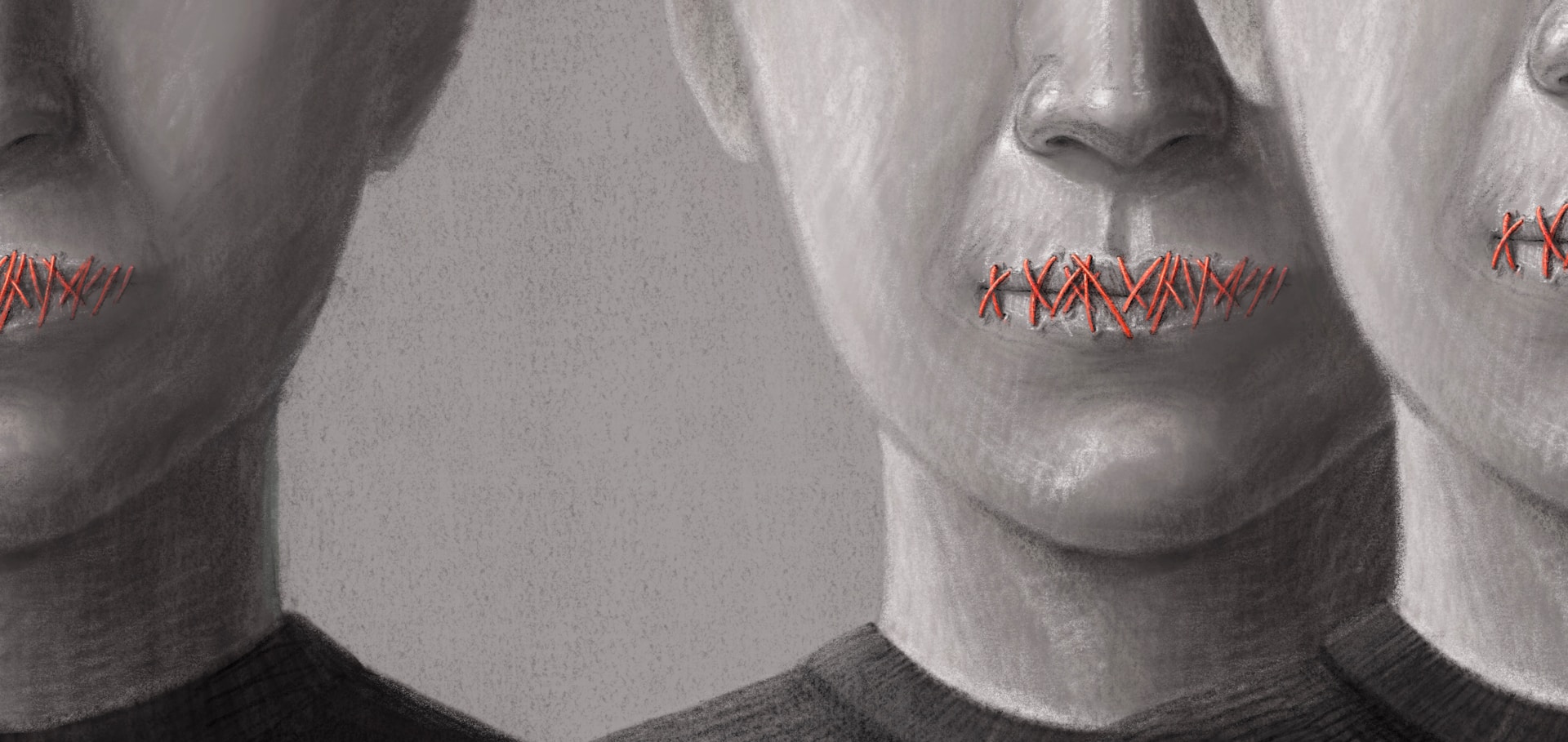

The Ninth U.S. Circuit Court of Appeals recently upheld the Securities and Exchange Commission’s (SEC) controversial “gag rule,” a policy that prevents defendants in civil enforcement cases from publicly admitting or denying the allegations and from publicly criticising the SEC once a settlement is reached. This rule, which has been in place since 1972, has faced significant opposition, with critics arguing it infringes upon defendants’ First Amendment rights by stifling free speech.

The court’s 3-0 ruling on August 6, 2025, reinforced the SEC’s authority to impose such restrictions, emphasizing the voluntary nature of settlements. Defendants, the court stated, retain the option to reject settlement offers and continue with litigation, which preserves their constitutional right to free speech. Circuit Judge Daniel Bress underlined that while the gag rule limits speech, it is not inherently unconstitutional as it forms part of a broader settlement offer that defendants can choose to accept or decline.

Despite the court’s affirmation of the rule’s constitutionality, the case underscores a wider legal tension. Legal experts continue to debate whether this form of settlement practice infringes upon free speech, especially when it limits public dispute of the SEC’s allegations. This ruling opens the door for future challenges, with the potential for the application of the gag rule to be contested on a case-by-case basis.

The case involved several high-profile figures, including Barry Romeril, the former CFO of Xerox, who had previously raised concerns about the gag rule. Supporters of the rule argue that it plays an essential role in facilitating settlements, offering a faster, more efficient resolution to complex cases. However, critics argue that it prioritises regulatory convenience over individual rights.

Ultimately, this ruling draws attention to the ongoing balancing act between regulatory efficiency and the protection of constitutional rights. As the SEC continues to enforce this policy, legal professionals and rights advocates alike will be closely monitoring how it is applied and whether further legal challenges will arise.